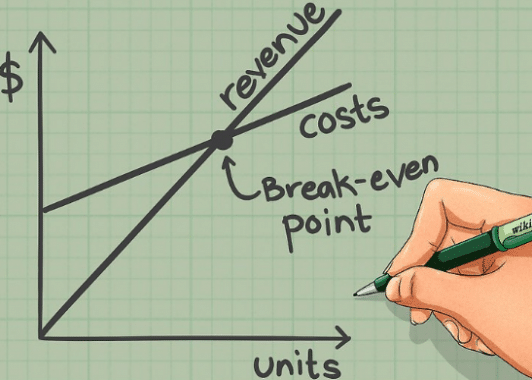

While there are exceptions and complications that could be incorporated, these are the general guidelines for break-even analysis.Īs you can imagine, the concept of the break-even point applies to every business endeavor-manufacturing, retail, and service. After the next sale beyond the break-even point, the company will begin to make a profit, and the profit will continue to increase as more units are sold. At this stage, the company is theoretically realizing neither a profit nor a loss. Once we reach the break-even point for each unit sold the company will realize an increase in profits of \(\$150\).įor each additional unit sold, the loss typically is lessened until it reaches the break-even point. This relationship will be continued until we reach the break-even point, where total revenue equals total costs. If it subsequently sells units, the loss would be reduced by \(\$150\) (the contribution margin) for each unit sold. This loss explains why the company’s cost graph recognized costs (in this example, \(\$20,000\)) even though there were no sales. It would realize a loss of \(\$20,000\) (the fixed costs) since it recognized no revenue or variable costs. For example, assume that in an extreme case the company has fixed costs of \(\$20,000\), a sales price of \(\$400\) per unit and variable costs of \(\$250\) per unit, and it sells no units. Contact us if you have questions or need help working through the calculations.\) is that, because of the existence of fixed costs in most production processes, in the first stages of production and subsequent sale of the products, the company will realize a loss. Alternatively, breakeven can help gauge the effects of cost reduction plans. In addition, breakeven analysis can tell you the amount of incremental sales you need to recoup an investment, such as buying a new machine or hiring a new salesperson. Many companies use breakeven point to set revenue goals and prepare budgets. If either of these variables changes, the breakeven point will change. In the example, variable expenses must remain at 90% of revenue and fixed expenses must stay at $1 million.

Monthly breakeven = $10 million / 12 = $833,333Īs long as expenses stay within budget, the breakeven point will be reliable. Here’s how those numbers fit into the breakeven formula:Īnnual breakeven = $1 million / 1 – ($10.8 million / $12 million) = $10 million

For example, let’s suppose Division A generates $12 million in revenue, has fixed costs of $1 million and variable costs of $10.8 million. The basic formula for calculating the breakeven point is:īreakeven = fixed expenses / 1 – (variable expenses / sales).īreakeven can be computed on various levels: It can be estimated for the company overall or by product line or division, as long as you have requisite sales and cost data broken down. Examples: shipping costs, materials, supplies, advertising and training. If you had no sales revenue, you’d have no variable expenses and your semifixed expenses would be lower. Your sales volume determines the ebb and flow of these expenses. Examples: property taxes, salaries, insurance and depreciation. These are the expenses that remain relatively unchanged with changes in your business volume. To calculate your breakeven point, you need to understand a few terms:įixed expenses.

#Break even point formula in cost accounting plus#

More specifically, it’s where net income is equal to zero and sales are equal to variable costs plus fixed costs. It’s the point at which total sales are equal to total expenses. Here are the details.īreakeven can be explained in a few different ways. The breakeven point is fairly easy to calculate using information from your company’s income statement. Breakeven analysis can be useful when investing in new equipment, launching a new product or analyzing the effects of a cost reduction plan.

0 kommentar(er)

0 kommentar(er)